Breaking Down Fees and Interest on Equity Release Mortgages

Breaking Down Fees and Interest on Equity Release Mortgages

Blog Article

The Crucial Elements to Think About Before Requesting Equity Release Mortgages

Prior to requesting equity Release home mortgages, people have to thoroughly consider numerous vital variables. Recognizing the implications on their financial situation is crucial. This includes examining present revenue, possible future expenses, and the effect on inheritance. Additionally, exploring various item types and connected costs is crucial. As one navigates these intricacies, it is necessary to consider psychological connections to building versus useful monetary requirements. What other considerations might influence this substantial decision?

Understanding Equity Release: What It Is and Exactly how It Works

Equity Release permits home owners, commonly those aged 55 and over, to access the wealth connected up in their residential or commercial property without requiring to offer it. This monetary service enables people to disclose a section of their home's worth, supplying cash money that can be utilized for numerous purposes, such as home renovations, debt settlement, or enhancing retirement revenue. There are 2 major sorts of equity Release products: life time home loans and home reversion strategies. With a life time home loan, homeowners maintain ownership while borrowing versus the property, settling the finance and passion upon death or moving right into long-lasting care. Alternatively, home reversion includes marketing a share of the building in exchange for a round figure, enabling the home owner to remain in the home up until fatality. It is vital for potential applicants to recognize the ramifications of equity Release, including the effect on inheritance and potential fees linked with the arrangements.

Assessing Your Financial Situation and Future Needs

Just how can a house owner successfully assess their economic scenario and future needs prior to thinking about equity Release? They need to conduct an extensive assessment of their current earnings, expenditures, and savings. This includes reviewing monthly costs, existing debts, and any kind of possible income resources, such as financial investments or pensions. Recognizing cash money flow can highlight whether equity Release is necessary for monetary stability.Next, home owners must consider their future needs. This includes expecting potential healthcare costs, lifestyle adjustments, and any type of major expenditures that may emerge in retired life. Developing a clear budget plan can aid in establishing exactly how much equity may be needed.Additionally, seeking advice from a monetary advisor can supply understandings right into the long-term implications of equity Release. They can aid in straightening the home owner's financial scenario with their future objectives, making certain that any kind of choice made is informed and aligned with their general monetary well-being.

The Effect on Inheritance and Family Members Financial Resources

The choice to make use of equity Release home loans can substantially influence household finances and inheritance preparation. Individuals have to consider the ramifications of estate tax and exactly how equity circulation among heirs might change therefore. These variables can influence not just the monetary legacy left but also the partnerships among member of the family.

Inheritance Tax Ramifications

Lots of house owners think about equity Release home loans as a way to supplement retired life revenue, they might accidentally affect inheritance tax responsibilities, which can significantly impact household funds. When home owners Release equity from their property, the quantity borrowed plus passion accumulates, minimizing the value of the estate left to heirs. If the estate goes beyond the tax obligation threshold, this could result in a greater inheritance tax obligation costs. Furthermore, any type of continuing to be equity may be deemed as part of the estate, complicating the economic landscape for beneficiaries. Households should realize that the choice to accessibility equity can have lasting effects, potentially reducing the inheritance intended for loved ones. Mindful consideration of the ramifications is vital before proceeding with equity Release.

Family Financial Preparation

While taking into consideration equity Release home loans, family members must recognize the significant impact these financial choices can have on inheritance and overall family finances. By accessing home equity, home owners might lower the value of their estate, potentially influencing the inheritance entrusted to successors. This can lead to feelings of unpredictability or problem among member of the family concerning future economic assumptions. Furthermore, the prices connected with equity Release, such as interest prices and charges, can build up, diminishing the staying properties readily available for inheritance. It is vital for families to involve in open discussions about these concerns, ensuring that all participants comprehend the implications of equity Release on their long-term monetary landscape. Thoughtful preparation is important to stabilize instant monetary requirements with future family members heritages.

Equity Circulation Among Heirs

Equity circulation amongst successors can significantly change the monetary landscape of a household, specifically when equity Release home loans are entailed. When a homeowner chooses to Release equity, the funds removed may decrease the estate's overall worth, impacting what successors receive. This decrease can lead to disputes among member of the family, particularly if assumptions concerning inheritance differ. The commitments connected to the equity Release, such as repayment terms and interest build-up, can make complex monetary planning for successors. Family members need to think about exactly how these elements affect their lasting monetary health and wellness and partnerships. Seminar concerning equity Release decisions and their implications can aid guarantee a clearer understanding of inheritance dynamics and minimize potential conflicts among heirs.

Discovering Different Kinds Of Equity Release Products

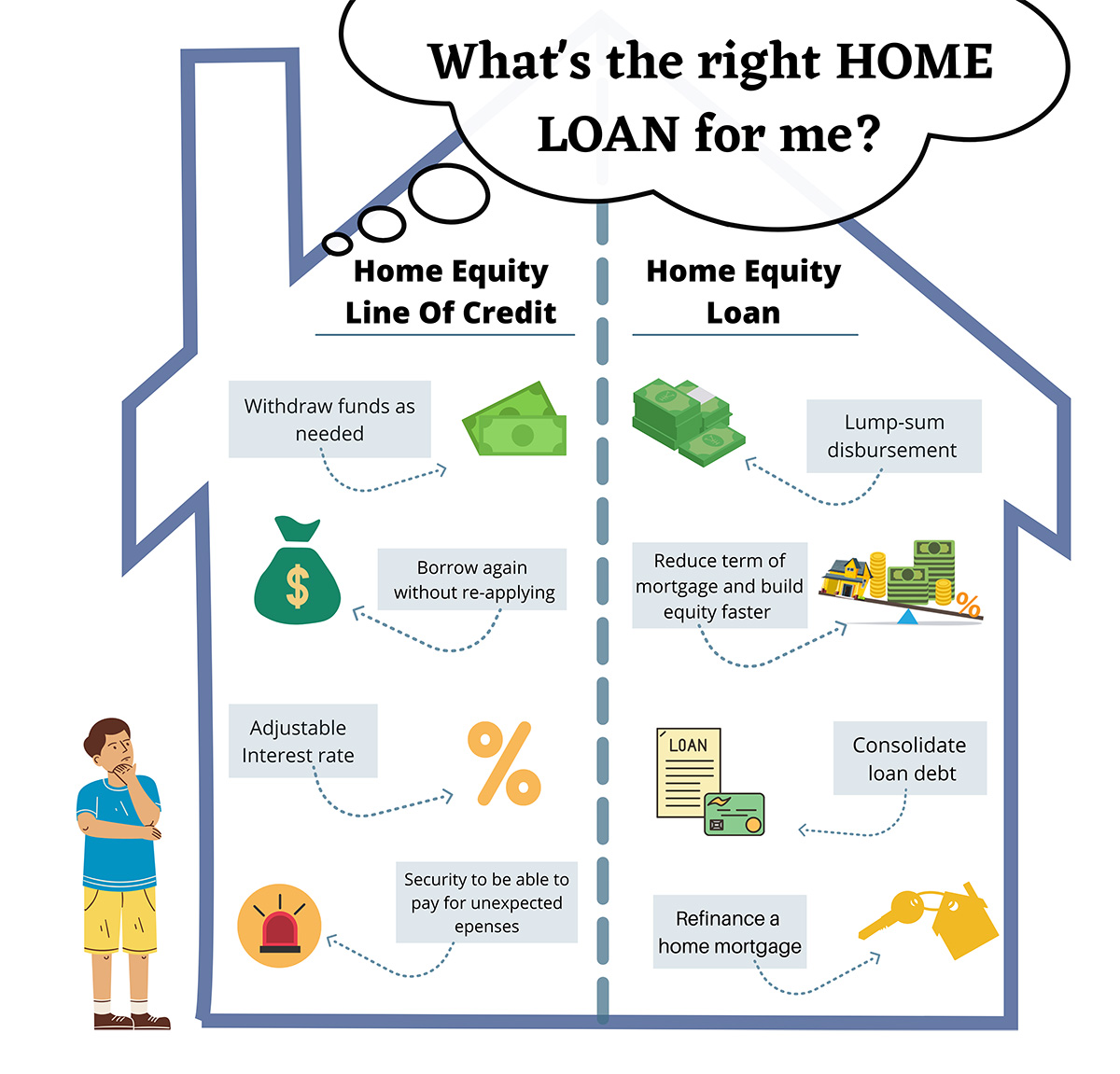

When considering equity Release choices, individuals can pick from numerous distinct items, each tailored to different financial needs and conditions. One of the most usual types include lifetime home loans and check home reversion plans.Lifetime home loans permit property owners to obtain versus their building worth while maintaining possession. The loan, together with built up interest, is settled upon the home owner's death or when they move right into long-term care.In contrast, home reversion intends entail selling a part of the home to a supplier in exchange for a swelling amount or routine payments. The property owner can continue living in the property rent-free up until fatality or relocation.Additionally, some products provide versatile functions, allowing customers to take out funds as needed. Each product lugs unique benefits and considerations, making it crucial for individuals to analyze their economic goals and long-term ramifications prior to choosing one of the most appropriate equity Release choice.

The Role of Interest Rates and Costs

Selecting the best equity Release item involves an understanding of numerous monetary variables, including passion prices and associated fees. Rates of interest can considerably influence the total price of the equity Release plan, as they figure out just how much the borrower will owe over time. Fixed rates supply predictability, while variable prices can vary, affecting long-lasting economic planning.Additionally, customers ought to understand any type of upfront costs, such as arrangement or assessment costs, which can contribute to the first expense of the home mortgage. Ongoing costs, consisting of yearly management costs, can additionally build up over the regard to the financing, possibly decreasing the equity readily available in the property.Understanding these expenses is essential for debtors to evaluate the total economic commitment and guarantee the equity Release product straightens with their monetary objectives. Mindful consideration of passion rates and costs can help individuals make notified decisions that fit their situations.

Looking For Professional Advice: Why It is very important

Exactly how can people navigate the complexities of equity Release home mortgages efficiently? Seeking expert advice is a necessary step in this process. Financial advisors and mortgage brokers have specialized knowledge that can brighten the intricacies visit this page of equity Release items. They can offer tailored advice based upon an individual's special financial situation, ensuring educated decision-making. Professionals can assist make clear problems and terms, recognize potential mistakes, and highlight the long-term ramifications of becoming part of an equity Release contract. Furthermore, they can help in comparing various choices, making sure that individuals select a strategy that aligns with their needs and objectives.

Reviewing Alternatives to Equity Release Mortgages

When taking into consideration equity Release home loans, individuals might find it useful to explore other financing alternatives that might much better suit their demands. This includes examining the possibility of scaling down to accessibility funding while keeping monetary stability. A thorough analysis of these options can result in even more educated choices regarding one's monetary future.

Other Funding Options

:max_bytes(150000):strip_icc()/dotdash_Final_Home_Equity_Loan_vs_HELOC_What_the_Difference_Apr_2020-01-af4e07d43f454096b1fbad8cfe448115.jpg)

Scaling down Considerations

Scaling down provides a feasible option for individuals thinking about equity Release home mortgages, especially for those aiming to access the worth of their residential or commercial property without sustaining extra financial debt. By marketing their current home and purchasing a smaller sized, a lot more budget-friendly building, homeowners can Release significant equity while lowering living expenditures. This option not just alleviates economic problems however also streamlines upkeep obligations connected with bigger homes. In enhancement, downsizing might offer a chance to relocate to a much more desirable location or a community customized to their way of living needs. It is vital for people to examine the psychological elements of leaving a long-time residence, as well as the potential prices included in moving. Cautious consideration of these elements can lead to an extra enjoyable economic decision.

Regularly Asked Concerns

Can I Still Move Residence After Taking Out Equity Release?

The person can still relocate residence after getting equity Release, but they have to assure the brand-new property satisfies the lender's standards (equity release mortgages). Additionally, they might require to repay the loan upon moving

What Occurs if My Residential Property Worth Lowers?

If a residential or commercial property's worth decreases after securing equity Release, the home owner might face lowered equity. Many plans use a no-negative-equity warranty, making certain that settlement quantities do not go beyond the residential property's worth at sale.

Exist Age Restrictions for Equity Release Applicants?

Age limitations for equity Release applicants typically call for people to be at the very least 55 or 60 years old, relying on the provider. These standards ensure that candidates are most likely to have enough equity in their residential property.

Will Equity Release Affect My Qualification for State Benefits?

Equity Release can potentially influence qualification for state advantages, as the released funds may be considered income or capital (equity release mortgages). Individuals must consult monetary advisors to understand exactly how equity Release impacts their specific advantage privileges

Can I Settle the Equity Release Home Loan Early Without Penalties?

Verdict

In recap, maneuvering with the complexities of equity Release home loans calls for cautious factor to consider of various factors, including economic circumstances, future demands, and the prospective effect on inheritance. Understanding the different item choices, connected costs, and the significance of expert guidance is necessary for making educated choices. By thoroughly assessing alternatives and stabilizing emotional attachments to one's home with practical economic requirements, individuals can establish one of the most ideal method to accessing their home equity sensibly (equity release mortgages). Developing a clear budget plan can assist in establishing how much equity may be needed.Additionally, consulting with a financial expert can provide understandings into the long-lasting effects of equity Release. Equity circulation amongst heirs can greatly modify the economic landscape of a family members, specifically when equity Release home loans are included. Continuous costs, consisting of yearly management charges, can likewise accumulate over the term of the lending, possibly minimizing the equity readily available in the property.Understanding these costs is necessary for borrowers to examine the complete economic dedication and guarantee the equity Release item aligns with their financial goals. If a home's value lowers after taking out equity Release, the house owner might face minimized equity. Equity Release can possibly impact qualification for state why not find out more advantages, as the launched funds might be taken into consideration earnings or funding

Report this page